Double Taxation Avoidance Treaty

The main purposes of the Treaty on the

Avoidance of Double Taxation and the Prevention of Fiscal Evasion are to promote economic cooperation between

countries and encourage foreign investments. The text of the treaties concluded by Georgia is based on OECD

Model Tax Convention, according to which taxing rights are distributed between treaty partners. Particularly,

resident of one Contracting State deriving income from the other Contracting State may be taxed whether in the

source state of income or in the country of residence. For the avoidance of double taxation, resident of one

Contracting State deriving income from the other Contracting State will be credited against tax in the source

state. DTA treaty also regulates issues regarding the prevention of fiscal evasion y means of implementing

internationally recognized standards of exchange of information for tax purposes.

“Double Taxation Avoidance” Treaties concluded by

Georgia

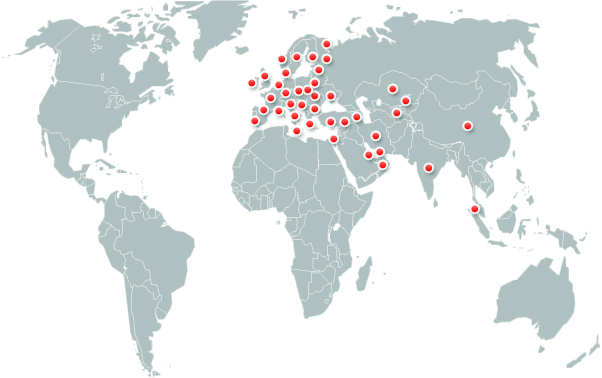

Currently 58 Treaties on the” Avoidance of Double Taxation and the Prevention of Fiscal Evasion” are in

force.

See attached treaties:

Austria *

(in force 01.03.06)

(protocol in force 01.03.13)

Ireland

(DTA, MLI Synthesised text)

The Netherlands

(DTA, MLI Synthesised text)

Belgium

(DTA, MLI Synthesised text)

Italy

(in force 19.02.04)

Poland

(in force 01.04.23)

Bulgaria

(in force 01.07.99)

Latvia *

(DTA, Protocol, MLI Synthesised text)

Romania

(in force 15.05.99)

United Kingdom

(DTA, Protocol, MLI Synthesised text)

Lithuania

(DTA, MLI Synthesised text)

Greece

(DTA, MLI Synthesised text)

Germany *

(in force 21.12.07)

(protocol in force 01.01.15)

Luxembourg

(DTA, MLI Synthesised text)

France

(DTA, MLI Synthesised text)

Denmark

(in force 23.12.08)

Malta

(in force 19.12.09)

Finland

(DTA, MLI Synthesised text)

Estonia *

(in force 27.12.07)

(protocol in force 11.03.11)

Czech Republic

(DTA, MLI Synthesised text)

Spain

(in force 01.07.11)

Azerbaijan

(in force 06.06.98)

Singapore

(DTA, MLI Synthesised text)

Ukraine

(in force 01.04.99)

Turkey

(in force 15.02.10)

Armenia

(in force 03.07.00)

China

(in force 10.11.05)

Turkmenistan

(in force 26.01.00)

Uzbekistan

(in force 20.10.97)

Kazakhstan

(in force 05.07.00)

Iran

(in force 14.02.01)

Qatar

(in force 11.03.11)

The United Arab Emirates

(in force 28.04.11)

.png)

Sweden

(in force 26.07.14)

Switzerland Confederation

(in force 07.07.11)

The State of Israel

(DTA, MLI Synthesised text)

India

(DTA, MLI Synthesised text)

Hungary

(DTA, MLI Synthesised text)

Slovakia

(DTA, MLI Synthesised text)

Bahrain

(in force 01.08.12)

Norway

(DTA, MLI Synthesised text)

Egypt

(in force 20.12.12)

Serbia

(DTA, MLI Synthesised text)

San Marino

(DTA, MLI Synthesised text)

Slovenia

(DTA, MLI Synthesised text)

Kuwait

(in force 14.04.13)

.png)

Croatia

(DTA, MLI Synthesised text)

Portugal

(DTA, MLI Synthesised text)

Japan

(in force 23.07.21)

Belarus

(in force 24.11.15)

Iceland

(DTA, MLI Synthesised text)

Cyprus

(DTA, MLI Synthesised text)

Korea

(DTA, MLI Synthesised text)

Liechtenstein

(DTA, MLI Synthesised text)

Moldova

(in force 17.04.2018)

Kingdom of Saudi Arabia

(in force 01.04.2019)

Hong Kong

(in force 01.07.21)

Kyrgyz

(in force 29.05.23)

Terms of Agreement

| State |

Permanent establishment, months |

Dividends |

Interest |

Royalties |

| Austria(2)

|

6 months |

10%/0% |

0% |

0% |

| Azerbaijan |

6 months |

10% |

10% |

10% |

| United Arab Emirates |

6 months |

0% |

0% |

0% |

| Belgium |

9 months |

5% / 15% |

10 % |

5% / 10% |

| Bulgaria |

9 months |

10% |

10% |

10% |

| United Kingdom |

12 months |

0% / 15% |

0% |

0% |

| Germany |

6 months |

0% / 5% /10% |

0% |

0% |

| Denmark |

6 months |

0% / 5% / 10% |

0% |

0% |

| Spain |

6 months |

0% / 10% |

0% |

0% |

| Estonia |

6 months |

0% |

0% |

0% |

| Turkey |

12 months |

10% |

10% |

10% |

| Turkmenistan |

6 months/183 days |

10% |

10% |

10% |

| India |

90 days |

10% |

10% |

10% |

| Israel |

9 months |

0/5 |

5% |

0% |

| Iran |

12 months |

5% / 10% |

10% |

5% |

| Italy |

6 months |

5% / 10% |

0% |

0% |

| Ireland |

6 months |

0% / 5% /10% |

0% |

0% |

| Japan |

6 months |

5%/10% |

5% |

0% |

| Qatar |

6 months |

0% |

0% |

0% |

| Lithuania |

9 months |

5% / 15% |

10% |

10% |

| Latvia |

9 months |

5%/10%/0% |

5% |

5% |

| Luxemburg |

6 months |

0% / 5% /10% |

0% |

0% |

| Malta |

6 months |

0% |

0% |

0% |

| Netherlands |

6 months |

0% / 5% / 15% |

0% |

0% |

| Poland |

9 months |

5% |

5% |

5% |

| Portugal |

9 months |

5%/10% |

10% |

5% |

| Rumania |

9 months |

8% |

10% |

5% |

| Greece |

9 months |

8% |

8% |

5% |

| Singapore |

9/183 days |

0% |

0% |

0% |

| Slovenia |

6 months |

5% |

5% |

5% |

| Armenia |

6 months/183 days |

5%/10% |

10% |

5% |

| France |

6 months |

0% / 5% / 10% |

0% |

0% |

| Uzbekistan |

6 months |

5% / 15% |

10% |

10% |

| Ukraine |

12 months |

5% / 10% |

10% |

10% |

| Hungary |

12 months |

0% / 5% |

0% |

0% |

| Finland |

6 months |

0% / 5% / 10% |

0% |

0% |

| Kazakhstan |

6 months |

15% |

10% |

10% |

| Switzerland |

6 months |

10%/0% |

0% |

0% |

| China |

6 months |

0%/5%/10% |

10% |

5% |

| Czech Republic |

6 months |

5% / 10% |

8% |

0% / 5% / 10% |

| Slovakia |

6 months |

0% |

5% |

5% |

| Bahrain |

6 months |

0% |

0% |

0% |

| Norway |

6 months /183 days |

5%/10% |

0% |

0% |

| Egypt |

6 months/183 days |

10% |

10% |

10% |

| Serbia |

9 months |

5%/10% |

10% |

10% |

| San Marino |

6 months |

0% |

0% |

0% |

| Kuwait |

6 months |

0%/5% |

0% |

10% |

| Croatia |

9 months |

5% |

5% |

5% |

| Belarus |

12 month |

5% / 10% |

5% |

5% |

| Iceland |

6 months |

5% / 10% |

5% |

5% |

| Cyprus |

9 months |

0% |

0% |

0% |

| Korea |

9 months |

5%/10% |

10%/0% |

5%/10% |

| Liechtenstein |

9 months |

0% |

0% |

0% |

| Moldova |

6 months/3 months |

5% |

5% |

5% |

| Kingdom of Saudi Arabia |

6 months |

5% / 0% |

5% / 0% |

5% / 8% |

| Hong Kong |

6 months |

5% |

5% |

5% |

| Kyrgyz |

6 months |

5%/10% |

0%/5% |

5%/10% |

Multilateral Tax

Convention (MLI)

On June 7, 2017 within the OECD ministerial, Georgia signed a “Multilateral Convention

to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting” (MLI).

The primary

purpose of the Multilateral Convention is implement BEPS treaty –related measures, in particular minimum

standards under BEPS Action 6 and 14 in treaties for the avoidance of double taxation.

Multilateral instrument will cover and amend respectively 34 out of 58

agreements on the avoidance of double taxation concluded by Georgia.

The Multilateral

instrument was ratified by the Parliament of Georgia on December 27, 2018 and the instrument of ratification has

been deposited within the OECD secretariat.

See attached text of the Convention:

Application of Double Tax Treaties

Granting of benefits under tax treaties concluded by Georgia is regulated by the Decree of the Minister of Finance N 633 as of December 28,

2011.

See attached Order:

The procedure defined by the agreement on the avoidance of double taxation

The Rule for the Mutual Agreement Procedure defined by the international agreement on the Avoidance of Double Taxation is approved by the Order of the Minister of Finance of Georgia

See attached Rule: