Double Taxation Avoidance Treaty

The main purposes of the Agreement on the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income and on Capital are to promote economic cooperation between countries and encourage foreign investments. Beginning from 2008 Georgia has initiated and concluded DTA agreements with its major trade partners. Georgian draft agreement is based on 2008 OECD Model Tax Convention on Income and on Capital, according to which taxing rights are distributed between treaty partners. Particularly, resident of one Contracting State deriving income from the other Contracting state may be taxed whether in the source state of income or in the country of residence. For the avoidance of double taxation, resident of one Contracting State deriving income from the other Contracting State will be credited against tax in the source state. DTA agreement also regulates issues regarding the prevention of fiscal evasion by means of implementing internationally recognized standards of exchange of information for tax purposes.

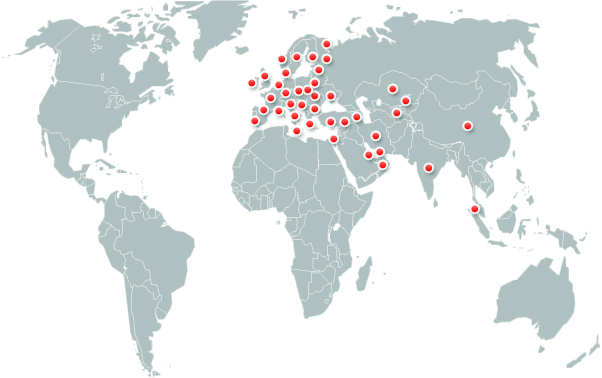

Currently Georgia has 55 active agreements.

Terms of Agreement

| State |

Permanent establishment, months |

Dividends |

Interest(1) |

Royalties |

| Austria(2) |

6 months |

0% / 5% /10% |

0% |

0% |

| Azerbaijan |

6 months |

10% |

10% |

10% |

| United Arab Emirates |

6 months |

0% |

0% |

0% |

| Belgium |

9 months |

5% / 15% |

10 % |

5% / 10% (3) |

| Bulgaria |

9 months |

10% |

10% |

10% |

| United Kingdom |

12 months |

0% / 15% (7) |

0% |

0% |

| Germany |

6 months |

0% / 5% /10% (6) |

0% |

0% |

| Denmark |

6 months |

0% / 5% / 10% (2) |

0% |

0% |

| Spain |

6 months |

0% / 10% |

0% |

0% |

| Estonia |

9 months |

0% |

0% |

0% |

| Turkey |

12 months |

10% |

10% |

10% |

| Turkmenistan |

6 months |

10% |

10% |

10% |

| India |

90 days |

10% |

10% |

10% |

| Israel |

9 months |

5% |

15% |

0% |

| Iran |

12 months |

5% / 10% |

10% |

5% |

| Italy |

6 months |

5% / 10% |

0% |

0% |

| Ireland |

6 months |

0% / 5% /10% |

0% |

0% |

| Japan |

12 months |

15% |

0%/10% |

0%/10% |

| Qatar |

6 months |

0% |

0% |

0% |

| Lithuania |

9 months |

5% / 15% |

10% |

10% |

| Latvia |

6 months |

5% |

5% |

10% |

| Luxemburg |

6 months |

0% / 5% /10% |

0% |

0% |

| Malta |

6 months |

0% |

0% |

0% |

| Netherlands |

6 months |

0% / 5% / 15% (2) |

0% |

0% |

| Poland |

6 months |

10% |

10% |

10% |

| Portugal |

9 months |

5%/10% |

10% |

5% |

| Rumania |

9 months |

8% |

10% |

5% |

| Greece |

9 months |

8% |

8% |

5% |

| Singapore |

6 months |

0% |

0% |

0% |

| Slovenia |

6 months |

5% |

5% |

5% |

| Armenia |

6 months |

5% / 10% |

10% |

5% |

| France |

6 months |

0% / 5% / 10% |

0% (5) |

0% |

| Uzbekistan |

6 months |

5% / 15% |

10% |

10% |

| Ukraine |

12 months |

5% / 10% |

10% |

10% |

| Hungary |

12 months |

0% / 5% |

0% |

0% |

| Finland |

6 months |

0% / 5% / 10% (2) |

0% |

0% |

| Kazakhstan |

6 months |

15% |

10% |

10% |

| Switzerland |

6 months |

10% |

0% |

0% |

| China |

6 months |

0% / 5% / 10% (2) |

10% |

5% |

| Czech Republic |

6 months |

5% / 10% |

8% |

0% / 5% / 10% (4) |

| Slovakia |

6 months |

0% |

5% |

5% |

| Bahrain |

6 months |

0% |

0% |

0% |

| Norway |

6 months |

5/10% |

0% |

0% |

| Egypt |

6/183 days |

10% |

10% |

10% |

| Serbia |

9 months |

5%/10% |

10% |

10% |

| San Marino |

6 months |

0% |

0% |

0% |

| Kuwait |

6 months |

0%/5% |

0% |

10% |

| Croatia |

9 months |

5% |

5% |

5% |

| Belarus | 12 month | 5% / 10% | 5% | 5% |

| Iceland | 6 months | 5% / 10% | 5% | 5% |

| Cyprus |

9 months |

0% |

0% |

0% |

| Korea | 9 months | 5% / 10% | 10% | 10% |

| Liechtenstein | 9 months | 0% | 0% | 0% |

| Moldova | 12 months | 5% | 5% | 5% |

| Kingdom of Saudi Arabia | 6 months | 5% / 0% | 5% / 0% | 5% / 8% |

Global Forum on Transparency and Exchange of Information

The Global Forum is the premier international body for ensuring the implementation of the internationally agreed standards of transparency and exchange of information in the tax area. The Global Forum now has

134 members, including G20 members and all OECD member countries.

On April 11, 2011

Georgia became a member of

the Global Forum on Transparency and Exchange of Information for Tax Purposes On 29 April 2014 Georgia was nominated as a fully-fledged member of the Peer Review Group (PRG) starting in 2015 for the period of three years. The Group carries out an in-depth monitoring and peer reviews of the implementation of the standards of transparency and exchange of information for tax purposes and works on the development of the relevant documentation for a robust, transparent and accelerated process.

The PRG consists of 30 Members.

In 2013-2014 experts of the Global Forum carried out Phase I review of Georgian legislation. Based on the aforementioned review, on August 4, 2014 Global Forum published a Report, according to which Georgia’s legal and regulatory framework has been recognized in line with the Global Forum international standards on transparency and exchange of information for tax purposes.

On 11 March 2016 Global Forum approved Phase 2 Peer review report of Georgia. Through the Review of the previous three years’ practice it was established that Georgia’s legislation and practice in the field of tax transparency and exchange of information comply with the international standard (Rating: “largely compliant).

Click here to see the Country compliance summary table.

Administrative Assistance in Tax Matters

On June 1, 2011 Georgia joined OECD and Council of Europe (COE) 1988 Convention on Mutual Administrative Assistance in Tax Matters. The primary purpose of this Convention is to ensure the provision of administrative assistance among member states, for the purposes of elimination of tax avoidance and evasion. Currently 87 states have signed to the Convention, including OECD member countries, European Council and financial centers.

Signatories to the Convention are available on the link below

http://www.oecd.org/ctp/exchange-of-tax-information/Status_of_convention.pdfAdditional information on Convention on Mutual Administrative Assistance in Tax Matters is available on the link below

http://www.oecd.org/ctp/exchange-of-tax-information/conventiononmutualadministrativeassistanceintaxmatters.htmBased on the Convention, Georgia has elaborated model bilateral agreement on “Mutual administrative assistance in tax matters”. Georgia has negotiated and concluded agreements with the following States:

the Republic of Armenia, the Republic of Azerbaijan,

the Republic of Uzbekistan,

Russian Federation,

Turkmenistan and

Ukraine.“

Exchange of Information in Tax Matters

Based on the Model Agreement on “Exchange of Information” Georgia has negotiated and concluded bilateral agreements with the Republic of Belarus and the Republic of Lithuania.

For the conclusion of the Agreements negotiations are held with Latvia, while texts of the agreements have been finalized with Seychelles and Bahamas.

For the conclusion of Memorandum on Automatic Exchange of Information negotiations are held with the Netherlands and Memorandum with Argentina has been signed. “

Mutual Administrative Assistance in Customs Matters

Georgia has negotiated and concluded 17 Agreements on Mutual Administrative Assistance in Customs Matters. These Agreements are based on the 2004 WCO Model Convention.

Agreements are in force with the following states: